Inflation and interest rates are the two primary culprits.

Bankruptcy can actually be a fix to this problem and is something that everyone should evaluate NOW. Does it make sense to clear the deck and start fresh? Especially when that deck is stacked against most Americans who are not otherwise wealthy. Especially, for anyone who has private student loans, the decision is pretty much a no brainer — bankruptcy can result in a full discharge of many private student loans or a very low payment plan, with very low interest. Basically, a way out.

High credit card balances, underwater vehicle loans, unpaid rent — bankruptcy can easily fix this.

So why should you consider bankruptcy if you simply cannot get ahead, no matter how hard you work? Inflation and interest are the barriers.

First, inflation. The Consumer Price Index (“CPI”) numbers which seemingly show low inflationary rates year after year (between 0% – 2.5% since 2008-2009) are faulty and leave out a large portion of expenses for every American.

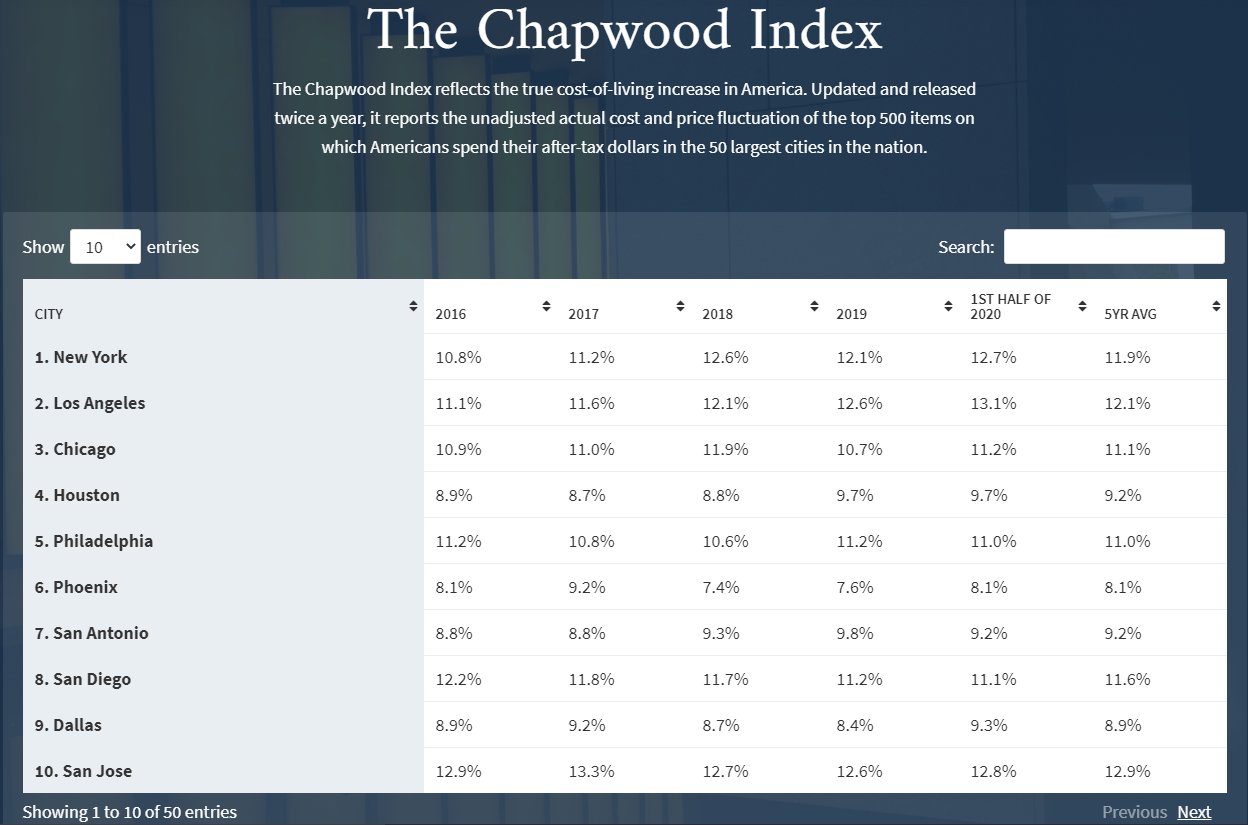

Instead of the CPI, take a look at the Chapwood Index. I see this index has been offline for the past week and I can’t locate a new URL for it unless it’s moving to a .org site here. This index shows that the real average inflation over the last five years has been between 8.1% and 12.9% in the top 10 cities. Take a look at this pic I found on Wayback – very enlightening.

This blind assumption that the CPI index accurately portrays the current inflation rate is a big reason why over 50% of Americans are dependent upon government entitlement programs to get by.

Second, interest rates. Those with poor credit scores, maxed out credit, high job turnover, crazy high debt to income ratios, have the highest interest rates. Rates that are often in excess of 8% — and up to 18% or sometimes more if allowed under our usury laws.

Case in point, I spoke with a client today about a vehicle loan he was trapped in. Despite a good income now, his normally very affordable 2018 Hyundai Elantra was 40% underwater (worth less than what was owed), and his interest rate was 18%. The reason for this was due to some things that happened to him before he got the great job. Plus the things in his past are likely to come knocking soon. Digging out from under these problems takes time, sometimes years of struggling and scrimping.

Please talk with us about your options, both bankruptcy and non-bankruptcy, to get clear of your debt once and for all. It’s amazing what you can do with your life once that happens. Please fill out our contact form below, text or call us to set an appointment to chat. Read through a few of our client reviews and see the difference we can make in someone’s life.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog