While the Income Driven Payment application process is shut down (paper applications were being processed, but now they too are reportedly on hold), to be first in line when it restarts, we suggest a paper application be sent to your loan servicer so it’s in the queue, and be sure to use the latest IDR application form. (Form #1845-0102 with an expiration date of 4/30/2027). Attached documentation of your income (latest tax return filed or a recent pay stub). You can try to upload it to your servicer, but with most of the online systems halted, it may be best to send via paper certified mail with a return receipt.

While the Income Driven Payment application process is shut down (paper applications were being processed, but now they too are reportedly on hold), to be first in line when it restarts, we suggest a paper application be sent to your loan servicer so it’s in the queue, and be sure to use the latest IDR application form. (Form #1845-0102 with an expiration date of 4/30/2027). Attached documentation of your income (latest tax return filed or a recent pay stub). You can try to upload it to your servicer, but with most of the online systems halted, it may be best to send via paper certified mail with a return receipt.

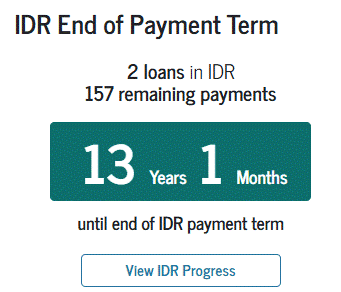

An Income Driven Payment is one way a borrower can remain current on their federal student loans who cannot afford their normal Standard payment. Please don’t ignore a student loan bill – it not only will incur late fees, but you will also have damage to your credit and the possibility of default which is not good for a federal student loan. Please read back through our blogs for some of the reasons why.

You may have some forbearance left. A couple days ago I blogged about forbearance options. This will not accrue credit toward forgiveness but it will keep your credit in good standing and avoid default.

Those with federal student loans have had a five year reprieve for collections on federal student debt. We are seeing more delinquencies as people do not not realize they were due to make a payment and for those borrowers who cannot afford to make a payment now.

Those with federal student loans have had a five year reprieve for collections on federal student debt. We are seeing more delinquencies as people do not not realize they were due to make a payment and for those borrowers who cannot afford to make a payment now. Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog