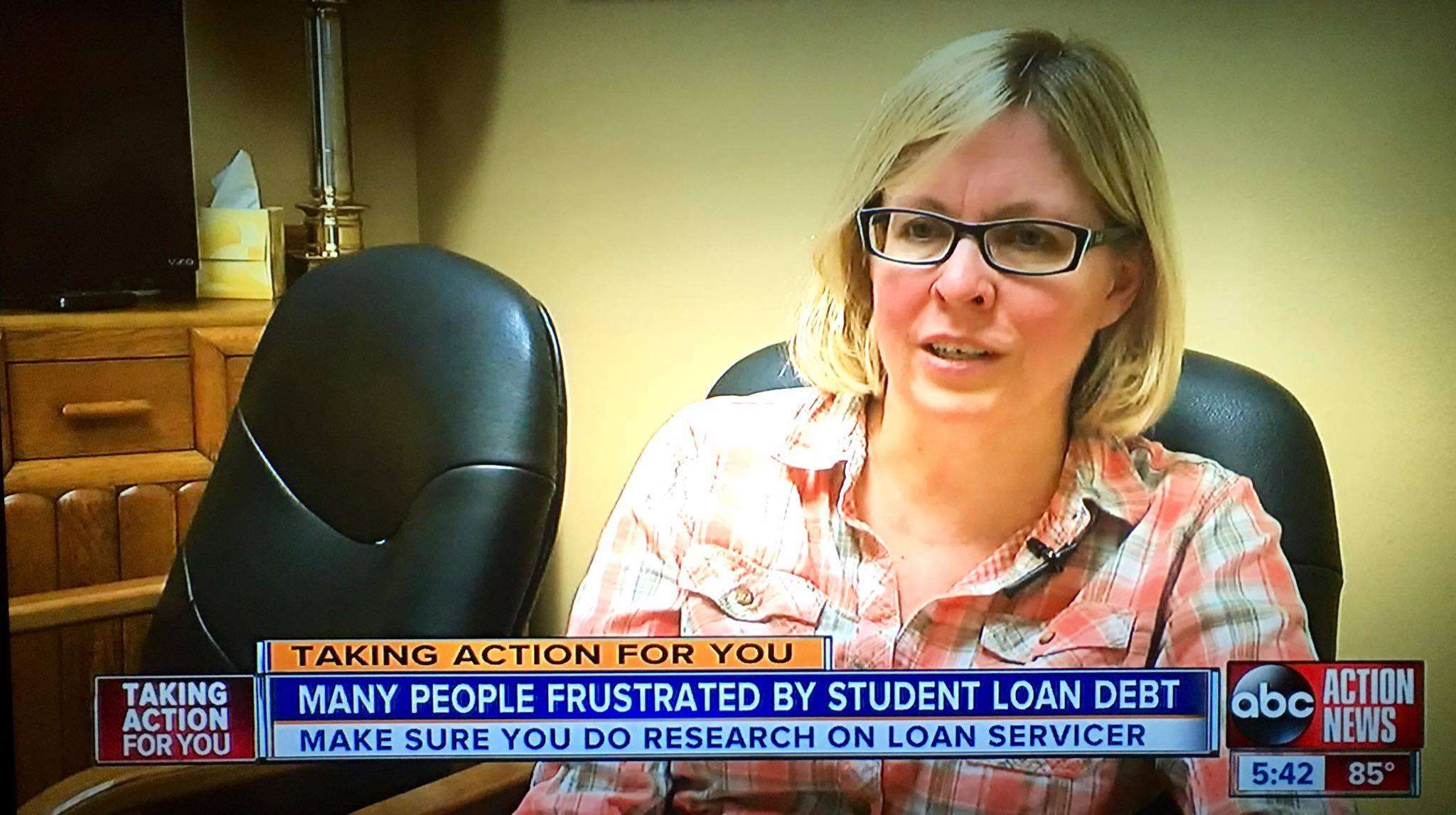

Highlighting a case where we obtained full student loan forgiveness of nearly $70,000 for an elderly client who had helped her son through school, ABC Action News interviewed our client and me today. The debt collectors wanted $700 a month in payments and were harassing her to make her payments. Now her payment is ZERO! The important thing to draw from this is to do your research. There are options for 9 out of 10 people who step into my office and don’t give up!

Highlighting a case where we obtained full student loan forgiveness of nearly $70,000 for an elderly client who had helped her son through school, ABC Action News interviewed our client and me today. The debt collectors wanted $700 a month in payments and were harassing her to make her payments. Now her payment is ZERO! The important thing to draw from this is to do your research. There are options for 9 out of 10 people who step into my office and don’t give up!

Articles Posted in Student loans

Why Hiring a Student Loan Attorney is a Good Idea

In my continued efforts to help student loan borrowers understand why hiring a student loan attorney is a good idea, I’d like to post some of the cases we are working on this week. Some of these are a little out of the ordinary and I’m hoping that other potential clients who have similar difficulties will contact us to help after they read this.

In my continued efforts to help student loan borrowers understand why hiring a student loan attorney is a good idea, I’d like to post some of the cases we are working on this week. Some of these are a little out of the ordinary and I’m hoping that other potential clients who have similar difficulties will contact us to help after they read this.

- We settled a case for a client who came to us with a private student loan default a couple months back. He had accidentally defaulted when he tried to put two student loans into forbearance. He was told to send a certain sum of money, and sign and return two forbearance agreements. He did that. Despite both agreements being placed in the same envelope, the unnamed bank claimed it had received only one. And they argued that two payments were due, not just one. So they put the default on his credit. Unfortunately, this default would prevent him from applying and obtaining a federal attorney position with a security clearance. He offered to pay them in full. No can do. The default would remain. He hired us. We tried to talk to the bank but we also hit a brick wall. So we sued. Within two weeks of hearing from the attorney representing the bank, we agreed to a removal of the default and a 50% settlement in exchange for a waiver of our claims. We sued under theories of negligence, negligent misrepresentation and the FCCPA. Our client is up for consideration for a federal job now, and we’ve asked that the default removal request be expedited so that it won’t come up in the background search. While we will never know for certain, the litigation we filed allowed the bank to “act outside of the box” and get this rectified.

- Another client came to us after being garnished on her federal loans for 8-9 years at $500 a month. I could hardly believe this had gone on for so long, but she didn’t think anything could be done since it was a student loan. She’s not alone, many people think that, including attorneys who don’t do student loan work. She is a teacher making $30k or so a month. She owes 82k and her loan balance despite the $500 wage garnishment is not going down and she feared having to pay it forever. With two kids of her own about to go to college, she couldn’t afford for this to continue. Our plan is to rehab the default to cure it, then consolidate the loans to re-characterize her FFEL loans so they are eligible for public service and then apply for a certain income based plan with debt forgiveness that would forgive the balance after 10 years under the public service program without considering her husband’s considerable income. When the dust settles we estimate her payment will be $300 for 10 years. She is good with that. The amount is based on her income (not her husband’s which is over 100k), is affordable and the best thing is it’s over in 10 years with no tax forgiveness.

Student Loan Admin Discharge Tax Relief Granted

Tax Relief for Certain Students Whose Education Loans Were Discharged: The IRS has announced that taxpayers, who took out Federal student loans to finance attendance at schools owned by Corinthian Colleges, Inc., and whose loans were discharged under the Department of Education’s Defense to Repayment or Closed School discharge processes, will not have to recognize gross income as a result of the debt discharge. Furthermore, these taxpayers will not be required to increase their taxes or income if they claimed Section 25A education credits or took Section 221 interest deductions or Section 222 higher education expense deductions in a prior year for payments made with proceeds of these discharged loans. This tax treatment is effective for tax years beginning in 2015. Rev. Proc. 2015-57, 2015-51 IRB .

Tax Relief for Certain Students Whose Education Loans Were Discharged: The IRS has announced that taxpayers, who took out Federal student loans to finance attendance at schools owned by Corinthian Colleges, Inc., and whose loans were discharged under the Department of Education’s Defense to Repayment or Closed School discharge processes, will not have to recognize gross income as a result of the debt discharge. Furthermore, these taxpayers will not be required to increase their taxes or income if they claimed Section 25A education credits or took Section 221 interest deductions or Section 222 higher education expense deductions in a prior year for payments made with proceeds of these discharged loans. This tax treatment is effective for tax years beginning in 2015. Rev. Proc. 2015-57, 2015-51 IRB .

This is great news for our Tampa Bay clients who had the back luck to go to one of these schools. Similar to letting an underwater home go, the tax forgiveness is potentially huge for student loans, principal reductions on mortgage modifications, short sales and foreclosures. Normally, a person would have to file bankruptcy to discharge the potential tax debt for written off or forgiven debt. For more information, please contact Arkovich Law

Federal Student Loan Collectors May Soon Be Able to Robocall With Impunity Due to New Budget Deal

The Washington Post reported yesterday that the latest congressional budget deal includes a provision to let companies collecting federal student loans (or other debts guaranteed by the government) call cellphones using auto-dialers.

The purpose of the bill is to increase communications in an attempt to keep more student loan borrowers current in their debt. However, the unintended consequences are likely to be increased harassment about payments not made, robo calls to relatives, references and co-borrowers and reassigned cell phone numbers. Calls which would no longer be under the protection of the Telephone Consumer Protection Act (“TCPA”).

The proposed amendment is to Section 227(b) of the Communications Act of 1934(47 U.S.C. 227(b), Restrictions on the Use of Telephone Equipment):

CFPB’s larger oversight role over student loans is needed – see report issued today!

New signs of trouble for student loan borrowers

New signs of trouble for student loan borrowers

BY SETH FROTMAN

Earlier this year, we asked you to share your stories about student debt stress. More than 30,000 of you responded, telling us that student loan servicers (the companies that send you a bill each month) can make it harder to manage your loans and may contribute to our nation’s growing student loan default problem.

Student Loan Nightmares at For-Profit Schools: Have Accreditation Agencies Dropped the Ball?

In our Florida student loan law practice, we see everyday the nightmarish situations our former students have gotten themselves into. One this week has me researching the differences between national versus regional accreditation. I’ve been a lawyer for 20 plus years and I hadn’t even known what this meant. My basic thought was accredited is good right? And no accreditation is bad. Should be simple, just make sure you go to an accredited school. Wrong.

In our Florida student loan law practice, we see everyday the nightmarish situations our former students have gotten themselves into. One this week has me researching the differences between national versus regional accreditation. I’ve been a lawyer for 20 plus years and I hadn’t even known what this meant. My basic thought was accredited is good right? And no accreditation is bad. Should be simple, just make sure you go to an accredited school. Wrong.

Actually, there are different types of accreditation which are commonly referred to as national versus regional. Again, you’d think national would be good right? But, no, regional is far better. For a client, a “national” accreditation means a much higher default rate (twice as many defaults in repayment of student loans) b/c the B.S. or B.A degree they studied hard for is not really worth what they thought it was. See a September 8, 2015 Center for American Progress Analysis RELEASE noting troubling high student loan default rates among colleges accredited by national accreditors. Default rates are important: they are another way of telling us that the education received has not warranted the student loans sought to be repaid for that education. If a student is unable to obtain employment in their field due to the inadequacy of their education, they are much more likely to not be able to repay their student loans.

Now, over 100k in student loans later, my client is faced with having to get a “replacement” B.S. degree if they hope to ever move up in their employment just because he chose a school, International Academy of Design and Technology, (“IADT”) that he thought was accredited, but was actually “nationally” accredited by the Accrediting Council for Independent Colleges and Schools. Our client was turned down a job specifically because of the type of accreditation behind his degree. Even though he was one of the lucky ones to have graduated (for-profit schools have a high dropout rate), it has done him no good whatsoever.

Florida Consumers can Revoke Consent to Call a Cell Phone (and there is no exception for private student loan debt collectors, just saying)

Revocation of Consent

Revocation of Consent

One of the pressing issues in pending litigation under the Telephone Consumer Protection Act (TCPA) is whether a consumer can revoke consent to receive calls on a cell phone. The TCPA requires prior express consent before a consumer can be contacted on a cell phone using an automatic dialer or prerecorded message, but the statute is silent on the right to revoke. So that raises two threshold questions: can prior express consent be revoked and, if so, what constitutes valid revocation?

There is a split in authority on whether consent can be revoked under the TCPA, but a number of courts are ruling that the conclusion that consent is revocable. The U.S. Court of Appeals for the Third Circuit was the first federal appellate court to address this issue. In Gager v. Dell Fin. Servs., LLC, 727 F.3d 265, 270-72 (3d Cir. 2013), the court held that a consumer has a right to revoke consent notwithstanding the absence of a statutory provision specifically authorizing revocation. Applying the common law concept of consent, the court reasoned that a right to revoke is not inconsistent with prior FCC decisions. Several courts have followed the Third Circuit’s lead, including the Eleventh Circuit (which governs the State of Florida) in Osorio v. State Farm Bank, F.S.B., 746 F.3d 1242 (11th Cir. Mar. 28, 2014).

National Collegiate Student Loan Trust Case Barred by Florida Statute of Limitations

Great news for Florida consumers with student loans! On April 21, 2015, the Middle District of Florida, Tampa Division, Bankruptcy Court issued a ruling on behalf of our client that a National Collegiate Student Loan Trust would be barred from pursuing student loans in Florida because the five year statute of limitations had expired. In doing so, the Court entered Final Judgment in favor of our client.

However, NCSLT apparently did not like this ruling and has subsequently filed an appeal. As neither party has submitted briefs yet, the outcome of the appeal remains unknown and should be resolved in approximately 4-6 months or less.

These clients owe a devastating $161,000 in private student loans. They also owe only about $20,000 in federal loans for which payments are current in a repayment program. However, prior to hiring us, these clients were not presented with realistic payment terms from the private lender. The household income for this family of four is only $40,000 as they have two young children and the wife stays at home to care for them.

Bankruptcy Relief for Student Loans May Be Changing?

Today, a legislator introduced a bill to treat student loan debt as other unsecured debt in a bankruptcy filing. This would be huge! As everyone knows, a bill isn’t a law and it could be awhile, but if this gains steam, we may have some relief for graduates over the past 20 years who are facing student loans that the new governmental forgiveness programs don’t cover.

Today, a legislator introduced a bill to treat student loan debt as other unsecured debt in a bankruptcy filing. This would be huge! As everyone knows, a bill isn’t a law and it could be awhile, but if this gains steam, we may have some relief for graduates over the past 20 years who are facing student loans that the new governmental forgiveness programs don’t cover.

Rep. John K. Delaney, D-Md., introduced the Discharge Student Loans in Bankruptcy Act (H.R. 449) on January 22, 2015. The bill itself can be found here. This link can also be used to track its progress through the House, Senate and finally the President if it makes it through. I just checked the link and the text of the bill isn’t up yet, but it should be in a couple days. I’ll be curious to see how it is worded and other legal commentators’ opinions of its likelihood of passage.

Presently, the burden to discharge student loans is not easy. The Brunner standard of what it takes to show an undue hardship is very difficult to meet. However, this 1987 case is starting to come under fire because of the impossible standards imposed. Over the past year, there have been approximately a dozen federal cases providing a framework for a new standard allowing for discharge of student loan debt. Brunner has some competition now.

Senior Citizen Social Security Being Garnished for Old Student Loans?

I’m looking for someone fitting this description to help to publicize this problem – CNN Money is interested in doing a story – Please contact me if you know someone who would be willing to share their story and be interviewed. Plus I may be able to help…

Stay tuned, I’ll update this blog post when the story develops.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog