Have you been considering walking away from your house payments and mortgage? According to a recent CNN article, many homeowners are getting ruthless and voluntarily choosing to walk away. We are seeing this more and more among our foreclosure defense and short sale clients. Sometimes it is better to take the credit hit and save money on huge mortgage payments on an underwater asset. Home values have continued to slide another 11% in Florida in February when compared to the same month in 2010. CBS MoneyWatch reports that 47% of Florida homeowners are underwater.

Have you been considering walking away from your house payments and mortgage? According to a recent CNN article, many homeowners are getting ruthless and voluntarily choosing to walk away. We are seeing this more and more among our foreclosure defense and short sale clients. Sometimes it is better to take the credit hit and save money on huge mortgage payments on an underwater asset. Home values have continued to slide another 11% in Florida in February when compared to the same month in 2010. CBS MoneyWatch reports that 47% of Florida homeowners are underwater.

Fannie Mae reports in a recent survey that the number of homeowners who would even consider walking away has increased from 15% to 27% this year. This is despite Fannie Mae’s threat to withhold Fannie Mae backed financing for strategic defaulters that it made over a year ago.

So what should you consider before you make such a decision? Well, first of all, if you have a good job, assets and a strong credit report, you can be a target for a deficiency lawsuit later down the road as Florida is a “recourse” state. Banks and other owners of mortgage debt have up to five years to pursue you to collect the unpaid balance. The question is will they? If you look good to them on paper, it is more likely you will be sued for a deficiency. If this is the case, or you think your finances will pick up over the next few years, you may want to consider a short sale to at least try to open negotiations for a full or partial deficiency waiver. Alternatively, many clients elect to file bankruptcy now while they qualify to order to obtain closure and gain the certain knowledge that they cannot be sued later.

Continue reading →

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Elusive principal reductions are hard to come by, but we recently scored a very big win on behalf of one of our prior

Elusive principal reductions are hard to come by, but we recently scored a very big win on behalf of one of our prior

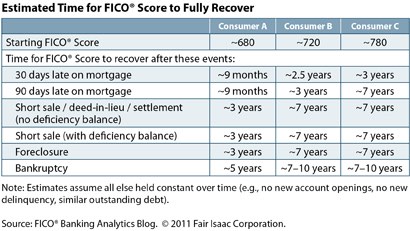

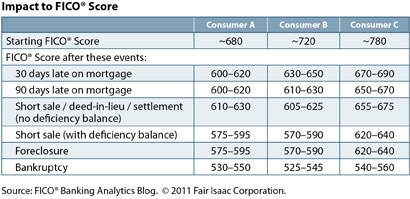

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy. In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed

In Florida, our Tampa Bay area homeowners are faced with a dilemma whether to claim the homestead exemption for their underwater homes. Historically, Florida homeowners have been allowed to keep or exempt $1,000 of personal property in a Chapter 7 bankruptcy. This isn’t much, and many homeowners had to pay the bankruptcy trustee to keep anything in excess of $1,000 per debtor. However, in the past few years, the Florida legislature passed  In a new incentive program beginning in late 2010, Chase is purportly offering $10,000 to $20,000 to homeowners who take the effort to short sale their property. The offer includes a waiver of any deficiency balance. But it only applies to loans actually owned by Chase, not just serviced by Chase. An

In a new incentive program beginning in late 2010, Chase is purportly offering $10,000 to $20,000 to homeowners who take the effort to short sale their property. The offer includes a waiver of any deficiency balance. But it only applies to loans actually owned by Chase, not just serviced by Chase. An