We recently filed a dispute for one of our clients for student loans that were not accurately reported on her credit reports following our settlement. What a difference it made — 595 to 749!

We recently filed a dispute for one of our clients for student loans that were not accurately reported on her credit reports following our settlement. What a difference it made — 595 to 749!

I’ve received a letter today from Equifax stating that the 4 disputed XXXX accounts have been “Deleted from the credit file”. I checked my Equifax report through credit karma and they are indeed gone making my score jump from 595 to 749!

One giant leap for studentkind! Over 150 points in one fell swoop. If you need help addressing your student debt or debt that is incorrectly being reported on your credit reports, please reach out to us.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

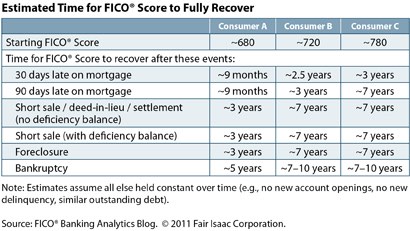

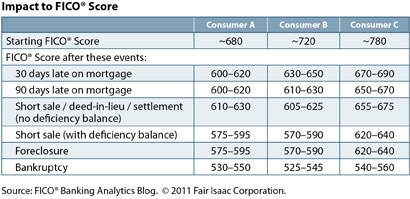

Traditionally in Florida, doing a short sale rather than allowing a foreclosure sale to occur is considered much better for your credit. Not so much difference in credit score per se, but mostly for future governmental financing when it is time to buy a home again.

Traditionally in Florida, doing a short sale rather than allowing a foreclosure sale to occur is considered much better for your credit. Not so much difference in credit score per se, but mostly for future governmental financing when it is time to buy a home again. It will take less time than you think to qualify to buy a home after bankruptcy. I generally advise my Florida clients that they will likely qualify within 2-5 years.

It will take less time than you think to qualify to buy a home after bankruptcy. I generally advise my Florida clients that they will likely qualify within 2-5 years.

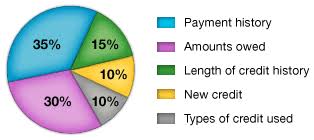

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.