While there are often legal disputes about what kind of phone system a caller is using, if you are receiving pre-recorded calls, they are usually always a violation of the Telephone Consumer Protection Act (“TCPA”). As 2018 nears an end, there is no sign that these cases are slowing down. The National Law Review published their case review on December 6, 2018 as to the recent case law developments. Lots of new court opinions on what constitutes an ATDS – automatic telephone dialing system – of course.

For more information, please view our short video prepared by Arkovich Law for tips about how you can stop these calls or obtain damages for $500 – $1,500 per call for those calls after you ask them to stop calling your cell phone.

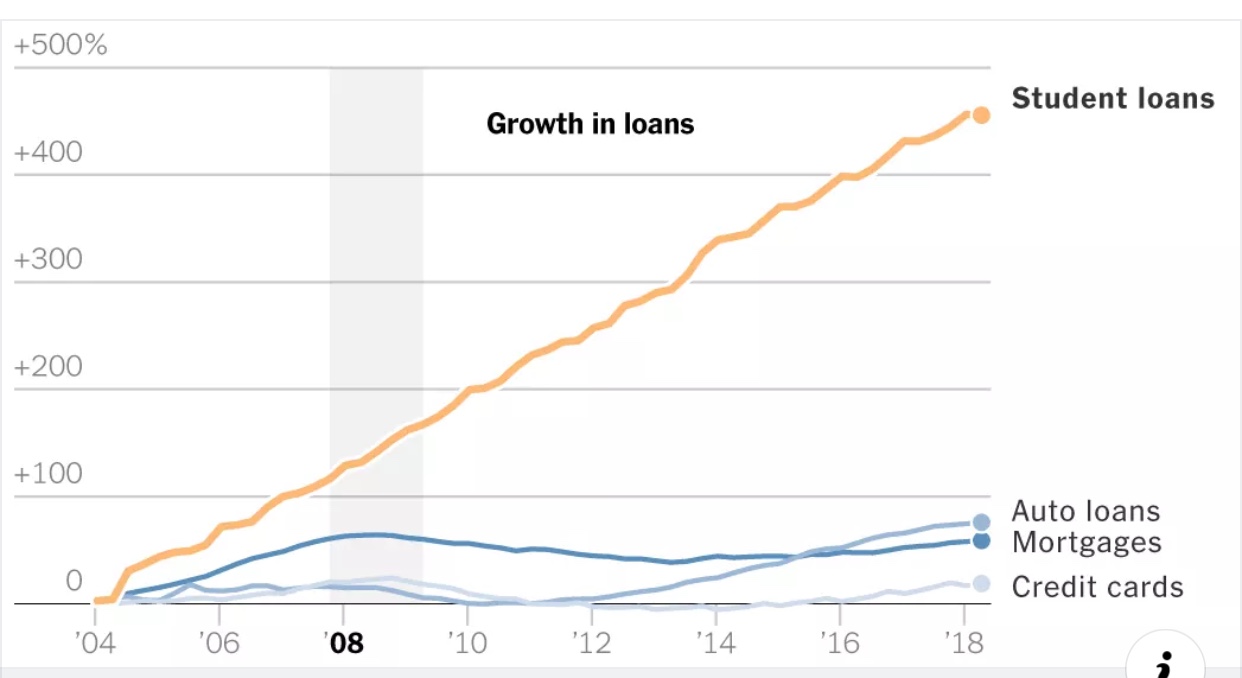

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog