Fortunately, there are several laws that provide both protection and damages for consumers facing errors on their credit reports. These include the Fair Credit Reporting Act (the “FCRA”), the Fair and Accurate Credit Transactions Act (“FACTA”) and most recently the Dodd-Frank amendments.

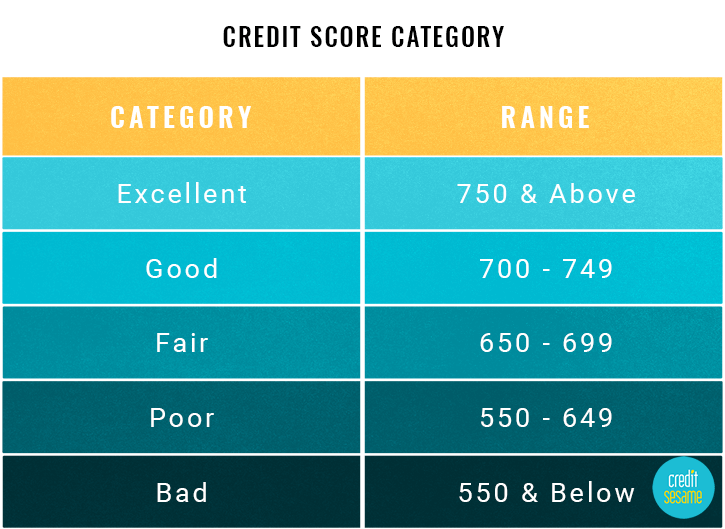

Credit reports are not only key to obtaining a home, vehicle, and credit cards, but they are also very important in obtaining employment, security clearances, insurance etc. Even if negative credit doesn’t prevent you from obtaining any of these things, you’ll pay a much higher interest rate if your credit has been damaged.

Pull your credit regularly to make sure your creditors are following the law and not causing you harm.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog