Our Florida clients have recently been asking me if there is a new law allowing them to reduce their mortgage balance to the value of their home. This is not accurate and I am not sure where this is coming from. My guess it may be from somewhat misleading and overly optimistic advertisement flyers that are sent to people who have a foreclosure filed against them.

Our Florida clients have recently been asking me if there is a new law allowing them to reduce their mortgage balance to the value of their home. This is not accurate and I am not sure where this is coming from. My guess it may be from somewhat misleading and overly optimistic advertisement flyers that are sent to people who have a foreclosure filed against them.

In bankruptcy, specifically a Chapter 13, we can strip a second mortgage. But the court cannot require a first mortgage company on a primary home to reduce the principal balance on their home. Implying otherwise, is simply misleading and inaccurate.

There is also no federal or state law that requires a first mortgage to be reduced to the value of the home.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Mortgage modifications are often determined by whether the owner (not servicer) is either a participant in HAMP or a recipient of TARP bailout funds.

Mortgage modifications are often determined by whether the owner (not servicer) is either a participant in HAMP or a recipient of TARP bailout funds. The Bankruptcy Court for the Middle District of Florida, Tampa Division, has recently implemented a mediation program for homeowners wishing to modify their first mortgages. The Orlando Division has had a

The Bankruptcy Court for the Middle District of Florida, Tampa Division, has recently implemented a mediation program for homeowners wishing to modify their first mortgages. The Orlando Division has had a  Let’s put into perspective the recent

Let’s put into perspective the recent  Our Florida clients sometimes ask me why they cannot strip off a second mortgage in a Chapter 7 like often done in a Chapter 13 bankruptcy nowadays. The limitation can be found in the United States Supreme Court’s decision in

Our Florida clients sometimes ask me why they cannot strip off a second mortgage in a Chapter 7 like often done in a Chapter 13 bankruptcy nowadays. The limitation can be found in the United States Supreme Court’s decision in  Bankruptcy clients who are new to Florida come to our office complaining about what I call the Exemptions Calculus Problem. Learning calculus seems simpler. Below are some useful sites and a brief explanation as to how exemptions work.

Bankruptcy clients who are new to Florida come to our office complaining about what I call the Exemptions Calculus Problem. Learning calculus seems simpler. Below are some useful sites and a brief explanation as to how exemptions work. Have you been considering walking away from your house payments and mortgage? According to a recent

Have you been considering walking away from your house payments and mortgage? According to a recent

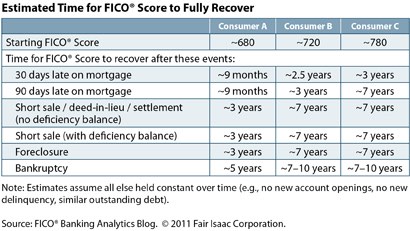

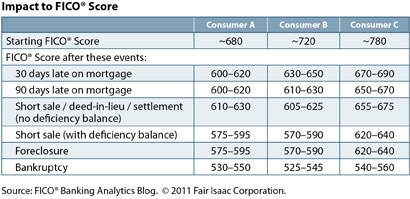

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.

A lot of our clients in the Tampa Bay area have questions regarding how exactly their credit score will be impacted by a short sale, foreclosure, or a bankruptcy.