How can you trust your student loan servicer when they don’t follow the law 61% of the time per a recent Inspector General’s Report?

How can you trust your student loan servicer when they don’t follow the law 61% of the time per a recent Inspector General’s Report?

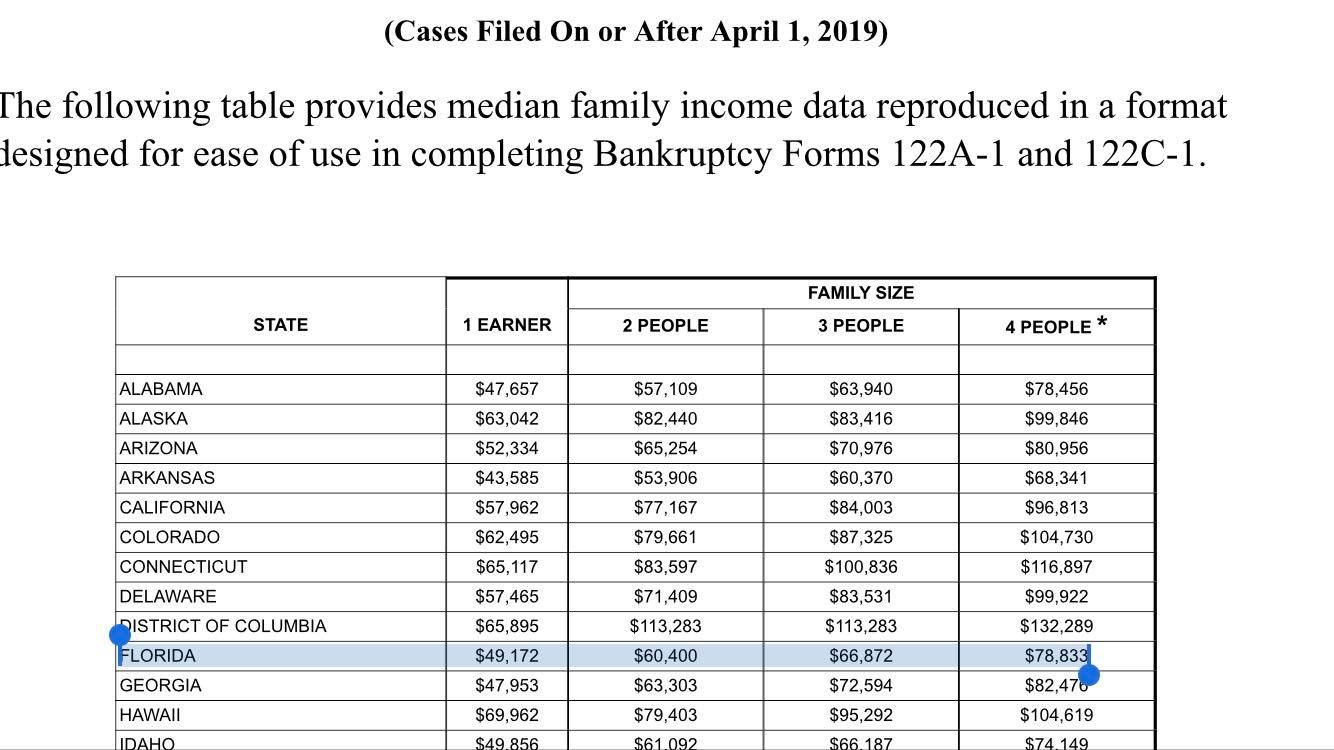

Let’s look at a relatively simple chore – re-certification of income under an income driven plan. What appears to be simple, can have meaningful impact. If nothing has changed, you likely can do it yourself – but do yourself a big favor and keep reading just in case. Here is a brief explanation of what we do to re-certify the borrower’s income to remain in an Income Driven Plan (IDR) for federal student loans:

When we are asked to re-certify an IDR plan, we ask that the borrower advise of their marital status, income of each spouse, # and circumstances of dependents, amount and type of federal loans, and lastly whether the borrower is working or intends to work public service. There are times that nothing has changed from the borrower’s prior circumstances the previous year and we likely would simply submit their tax return to renew. We would need to obtain a signed authorization form and often follow up with the servicer(s). We are often re-explaining how the forgiveness works, the 1099 expectation, impact on their credit, ability to qualify for a mortgage one day.

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog

Reboot Your Life: Tampa Student Loan and Bankruptcy Attorney Blog